No Management Responsibilities

The DST is the single owner and agile decision maker on behalf of investors.

Section 1031 of the Internal Revenue Code allows an investor to defer the payment of capital gains taxes that may arise from the sale of a business or investment property. By using the proceeds of the sale of such a property to purchase “like-kind” real estate, taxes may be deferred, as long as the investor satisfies certain conditions.

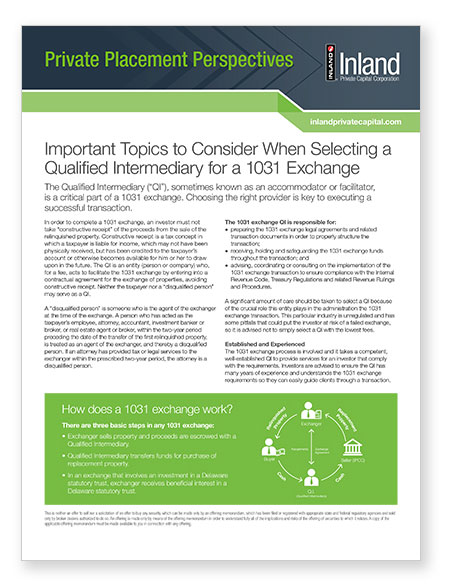

Exchanger sells property, known as the relinquished property, and the proceeds are escrowed with a Qualified Intermediary (QI)

Qualified Intermediary, through a written agreement with the investor, transfers funds for purchase of replacement property

Exchanger receives new property

or DST interest

Property exchangers must follow a specific timeline to take advantage of the benefits of a 1031 transaction. The entire 1031 exchange timeline can take no longer than 180 days.

To complete a successful Section 1031 tax-deferred exchange, the replacement property must be like-kind to the relinquished property. Some examples of like-kind properties include:

Any real estate held for productive use in a trade or business or for investment purposes is considered like-kind. A primary residence would not fall into this category, however, vacation homes or rental properties may qualify.

In order to complete a 1031 exchange, an investor must not take “constructive receipt” of the proceeds from the sale of the relinquished property. The Qualified Intermediary (QI) is an entity who, for a fee, acts to facilitate the 1031 exchange by entering into a contractual agreement for the exchange of properties, avoiding constructive receipt.

The DST is the single owner and agile decision maker on behalf of investors.

Most real estate investors can’t afford to own multimillion dollar properties. DSTs allow investors to acquire partial ownership in properties that otherwise would be out-of-reach.

Loans are nonrecourse to the investor. The DST is the sole borrower.

DSTs can accommodate much lower minimum investments, whereas 1031 exchange minimums often are $100,000.

Investors can divide their investment among multiple DSTs, which may provide for a more diversified real estate portfolio across geography and property types.

All 1031 exchange investments receive a step-up in cost basis so your heirs will not inherit capital gain liabilities, and provides them with professional real estate management versus the burden of hands-on management.

If for some reason the investor can’t acquire the original property they identified, a secondary DST option allows them to meet the exchange deadlines and defer the capital gains tax.

Any remaining profit on the sale of your relinquished property is considered “boot.” This remaining money becomes taxable unless you eliminate it. The excess cash (boot) can be invested in a DST to avoid incurring tax.

The DST structure allows the investor to continue to exchange real properties over and over again until the investor’s death.

Section 1031 of the Internal Revenue Code provides an alternative strategy for deferring capital gains tax that may arise from the sale of a property. By exchanging a relinquished property for “like-kind” real estate, property owners may defer federal taxes and use all proceeds from the sale for the purchase of replacement property. To determine if a transaction will qualify under Section 1031 depends on the following factors:

Vacation or second homes held by the exchanger primarily for personal use do not qualify for tax deferred exchange treatment under Section 1031. The safe harbor for a vacation or second home to qualify as relinquished property in a Section 1031 exchange requires the exchanger to have owned the property for twenty-four months immediately before the exchange, and within each of those two twelve-month periods the exchanger must have:

For these purposes, “personal use” includes use by the exchanger’s friends and family members that do not pay fair market value rent.

By investing in a DST, heirs may receive any distributions paid from the investments. Upon the sale of the property owned by the DST, each heir can choose what to do with their inherited portion. It is possible that one heir continues to exchange the investment, while another may sell and receive cash proceeds. Should the DST investor pass away, under the current tax laws, the heirs would get a “step-up” in tax basis, bringing the investment up to fair market value, thereby potentially deferring capital gains taxes on the original and subsequent properties.

Inland Private Capital investment programs are sold by broker dealers and registered investment advisors authorized to do so.

Contact your financial professional to learn more. Or, for help finding a financial professional:

Inland Private Capital Investment Programs are sold by broker dealers and registered investment advisors authorized to do so.

Connect with your Inland team to learn more: